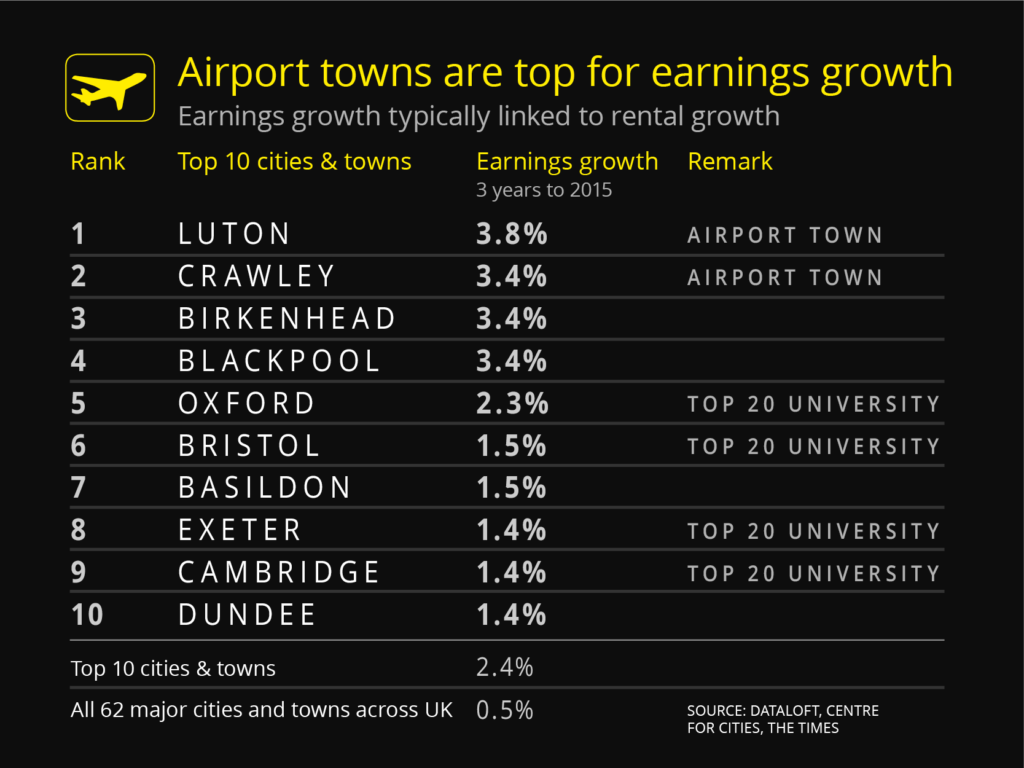

We regularly analyse a range of factors which help us build a picture of housing and rental demand across major town and cities in the UK. Examining real (inflation adjusted) earnings growth over a three year period to 2015, it is interestingly two airport towns, Luton and Crawley (for London Gatwick) which were the top performers. Earnings in Luton have growth by 3.8% per annum over this three year period and for Crawley 3.4% per annum. Their respective airports would have been critical drivers in this strong earnings growth.

Some of these league toppers have driven strong earnings growth from a low base – for instance 3rd on our league table growth is Birkenhead. Back in 2012 Birkenhead had the lowest per week earnings across the whole 62 major UK towns and cities sample. Despite this strong growth weekly earnings remain a wide margin below average.

Other locations which topped the league are the more familiar chart toppers: the likes of Cambridge, Exeter, Oxford and Bristol. These locations are characterised by highly rated universities or centres of excellence for research, or both.

High earnings growth in these locations is against a backdrop of low real earnings growth across the whole economy. Across all 62 cities and towns average earnings growth was only 0.5% per annum. Across the top ten it was 2.4% per annum.

What does this mean for the rental market? There is typically a very strong relationship between earnings growth and rental growth. A strong employment market fuels demand for rental properties.

There is of course a bigger picture with a range of other factors that need to be taken into account, demographics, economics, housing characteristics etc. Earnings growth is a good catch all though – behind good earnings growth is typically good productivity, a strong or strengthening local economy, high demand for jobs, high levels of new business start-ups or strong public policy support.